Pending Ratios & Inventory—Your Spring Market Playbook

Use pending ratios and inventory data to guide client strategies, set pricing, and create standout social posts in the MA/RI spring market.

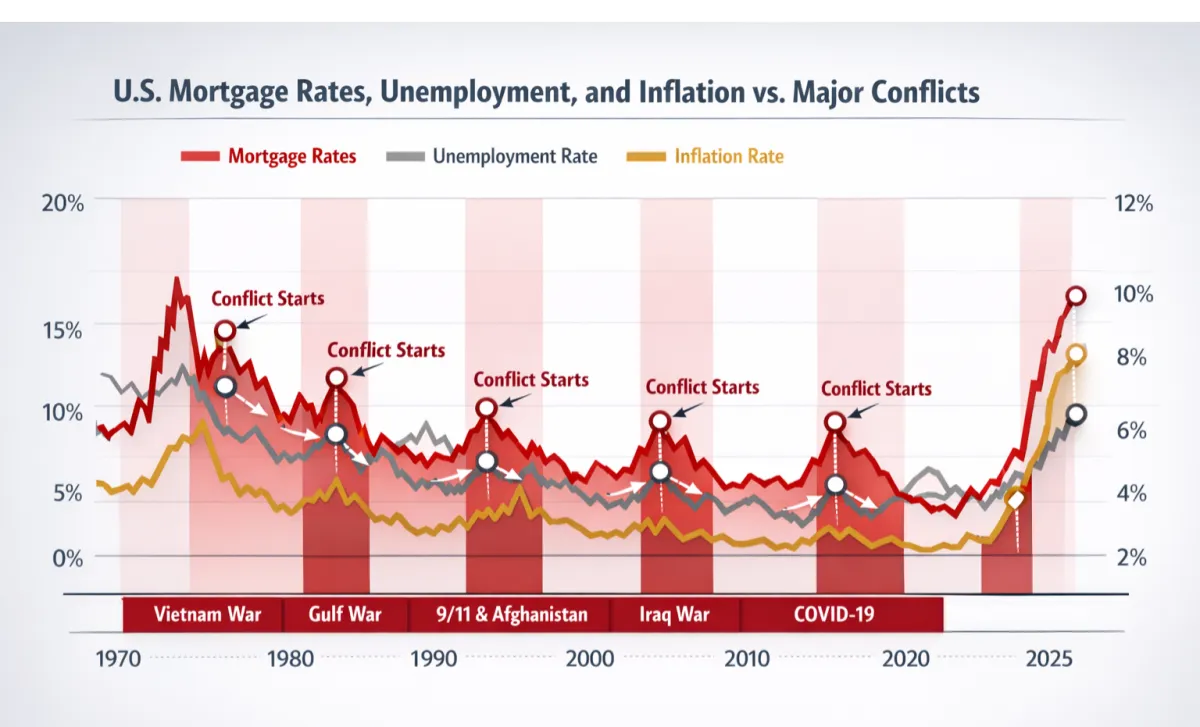

Are today’s low mortgage rates a real opportunity or just a mirage? See what history reveals about rates during global conflict, and how agents can guide clients in 2026’s uncertain market.

Discover how AI-powered audio tools like Pocket are changing the way agents learn, capture insights, and turn ideas into action. See why this tech is a game changer for real estate professionals in 2026.

A Tiverton, RI home packed with hand-painted murals and custom tilework went viral on Zillow Gone Wild. See why this local listing captured national attention and what it means for creative sellers.

Spring is prime time for decluttering—see the best local donation centers in Easton, Mansfield, Foxboro, and Franklin, and how your spring cleaning can help neighbors in need.