Why Mortgage Rates Just Fell—and What It Means for MA & RI

Mortgage rates slid to new 2025 lows after a string of weak labor data capped by August’s tepid jobs report.

Freddie Mac’s weekly survey showed the 30-yr fixed at ~6.50% for the week of Sept. 4 (lowest since last fall), while daily trackers dipped even lower after Friday’s report, briefly touching the 6.29% range.

The immediate driver wasn’t inflation—it was jobs. When the labor market cools, investors price in easier Fed policy, bond yields fall, and mortgage rates follow.

What the “shocking” jobs week actually said

Early in the week, JOLTS and ADP reports both hinted at cooling demand for workers, pushing rates lower even before the official jobs release. The Bureau of Labor Statistics confirmed the slowdown in August: payrolls added just +22,000 jobs, unemployment ticked up to 4.3%, and prior months saw downward revisions. Wages rose modestly—0.3% month-over-month, 3.7% year-over-year—not hot enough to spook bond markets.

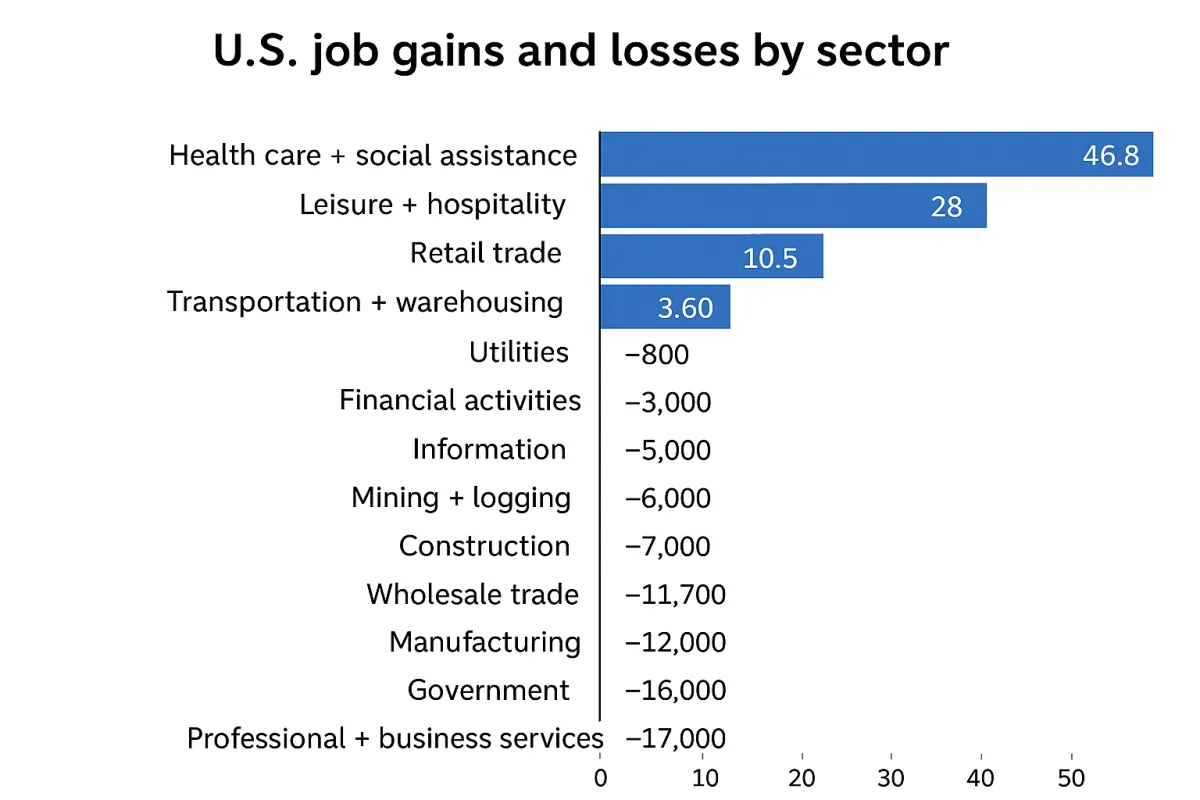

The sector breakdown told the real story. Health care was the lone standout (+31k jobs) with gains in social assistance (+16k). Losses hit the federal government (-15k), mining and oil & gas (-6k), wholesale trade (-12k), and manufacturing (-12k)—including transportation equipment (-15k), partly strike-related. That’s a tilt toward weakness in goods-producing and cyclical areas, exactly the kind of mix that cools inflation pressures.

And cooling inflation is what we’re going for. It’s been hot since President Biden took office and, if we’re being truthful, has been since Covid… and while President Trump is taking the heat, it was baked into the cake.

Bottom line: investors now expect the Fed to lean more dovish. To get mortgage rates sustainably under 6%, the Fed has to help—but a softer labor market is the prerequisite.

Why a Soft Labor Market Matters for Rates

Think of the labor market as the thermostat for inflation. When hiring slows, unemployment edges higher, and wage growth cools, the economy gives off less “heat.” Investors then expect the Federal Reserve to ease policy or cut rates, which drives Treasury yields lower. Mortgage rates, which follow those yields, can only drift sustainably under 6% if the labor market stays soft enough to keep inflation in check.

Will falling rates “unfreeze” our market?

In Massachusetts and Rhode Island, affordability has been whipsawed by rates more than prices. A dip from ~6.8% to the low-6s can add meaningful purchasing power—often the difference between one more bedroom or a better school district. Expect:

More refinance chatter (refis already trending higher… see chart “Refinance Index vs 30 Yr Fixed). If you’re considering if refinancing makes sense for you, reach out to me… let’s talk about it.

A modest demand bump from pent-up buyers who were waiting for a clear downtrend.

Inventory still tight, so pricing power doesn’t flip overnight—especially in Boston-proximate suburbs.

1

Where could rates be by late Q4… and early 2026?

Base case (most likely): Labor cools further, the Fed cuts, 10-year yields drift down → mortgage rates stabilize in the low-6s in Q4 and threaten high-5s in early 2026 if incoming data stays soft.

Upside risk (rates higher): A rebound in hiring/wages or sticky services inflation could stall the down-move and keep rates mid-6s into 2026.

Downside tail (rates lower): If payrolls turn negative and unemployment rises faster, bonds could rally hard—5.75–5.95% mortgage rates become plausible for stretches.

How to interpret sector losses

August weakness clustered in federal employment, manufacturing (especially transportation equipment), wholesale trade, and energy. For housing, that mix tends to cool big-ticket purchases and reduce wage pressure, both of which help mortgage rates. It’s not “good” for the economy per se, but it is supportive of lower financing costs for buyers.

This is important to understand. Inflation has not gone away.

2

Remember the goal is 2%... so we should not be lowering rates unless the jobs data isn’t great. This is not a Democrat vs Republican thing, either. Whoever took over the White House was dealt a crappy hand and there’s no quick fix!

What to do now (buyers, sellers, agents)

Buyers: Update pre-approvals immediately; a 40–60 bps drop can increase your budget or lower your payment. Ask lenders for a re-price and compare buydown options while volatility favors you.

Sellers: Price for the market you’re in, not the one you want. Lower rates may bring more showings, but buyers are still payment-sensitive. Use recent comps plus your micro-market DOM to set list price, and keep concessions/credits as tools rather than afterthoughts.

Agents: Call your hot list with a simple script: “Rates hit new 2025 lows after a weak jobs report. Your monthly payment on $X just dropped by ~$Y. Want me to re-run your numbers?” Also, align with lenders on buydowns, lock/float guidance, and refi strategy if rates push into the low-6s.

¹ “Mortgage Applications”, mortgagenewsdaily.com, Mortgage New Daily, LLC, Last updated September 5, 2025, Accessed September 7, 2025, https://www.mortgagenewsdaily.com/data/mortgage-applications

² “Current US Inflation Rates: 2000-2025”, usinflationcalculator.com, Coinnews Media Group LLC, Last updated: August 11, 2025, Accessed September 7, 2025, https://www.usinflationcalculator.com/inflation/current-inflation-rates/

References

HousingWire – Jobs week & sub-6% context; JOLTS/ADP impact on rates; post-NFP analysis

Freddie Mac PMMS – 30-yr fixed at 6.50% (week of Sept. 4) + trend commentary

Mortgage News Daily – Daily rate prints to ~6.29% after the August jobs report

Bureau of Labor Statistics (Aug 2025) – Payroll +22k; UR 4.3%; sector details (health care +31k; federal -15k; mining -6k; wholesale -12k; manufacturing -12k; trans. equip. -15k)

WSJ / Reuters – Labor-market stall context and revisions