Mortgage Rate Volatility vs. Direction: Why Predicting Rates Has Become Useless

Mortgage Rate Volatility vs. Direction: Why Predicting Rates Has Become Useless (and What Actually Matters Instead)

If you’ve followed mortgage rates at all over the last two years, you’ve probably felt this strange whiplash:

Rates spike.

Rates dip.

Rates rally for a week.

Rates reverse the next.

30-Year Fixed Rate Mortgage Average in the US 1/8/25-1/8/26 (Federal Reserve Bank of St Louis)

And yet, after all that motion, buyers and sellers often end up right back where they started — confused, hesitant, and waiting for “clarity” that never seems to arrive… or, my favorite, when they tell me that they’re waiting for the rate to go below 5% again (because, as they say, it has to). 🙄

That raises an uncomfortable question we don’t ask often enough:

What if predicting where mortgage rates are going next… just isn’t that helpful anymore?

Because when you zoom out, the real story of 2024–2025 hasn’t been direction.

It’s been volatility.

And volatility changes behavior far more than a clean up-or-down trend ever did.

We’re conditioned to think in straight lines — but the market no longer moves that way

For decades, people were trained to think about mortgage rates like this:

Rates are falling → wait, you’ll get a better deal

Rates are rising → hurry, or you’ll miss your chance

That logic worked when rates moved slowly, predictably, and in long arcs.

30-Year Fixed Rate Mortgage Average in the US 1/8/15-1/8/16 (Federal Reserve Bank of St Louis)

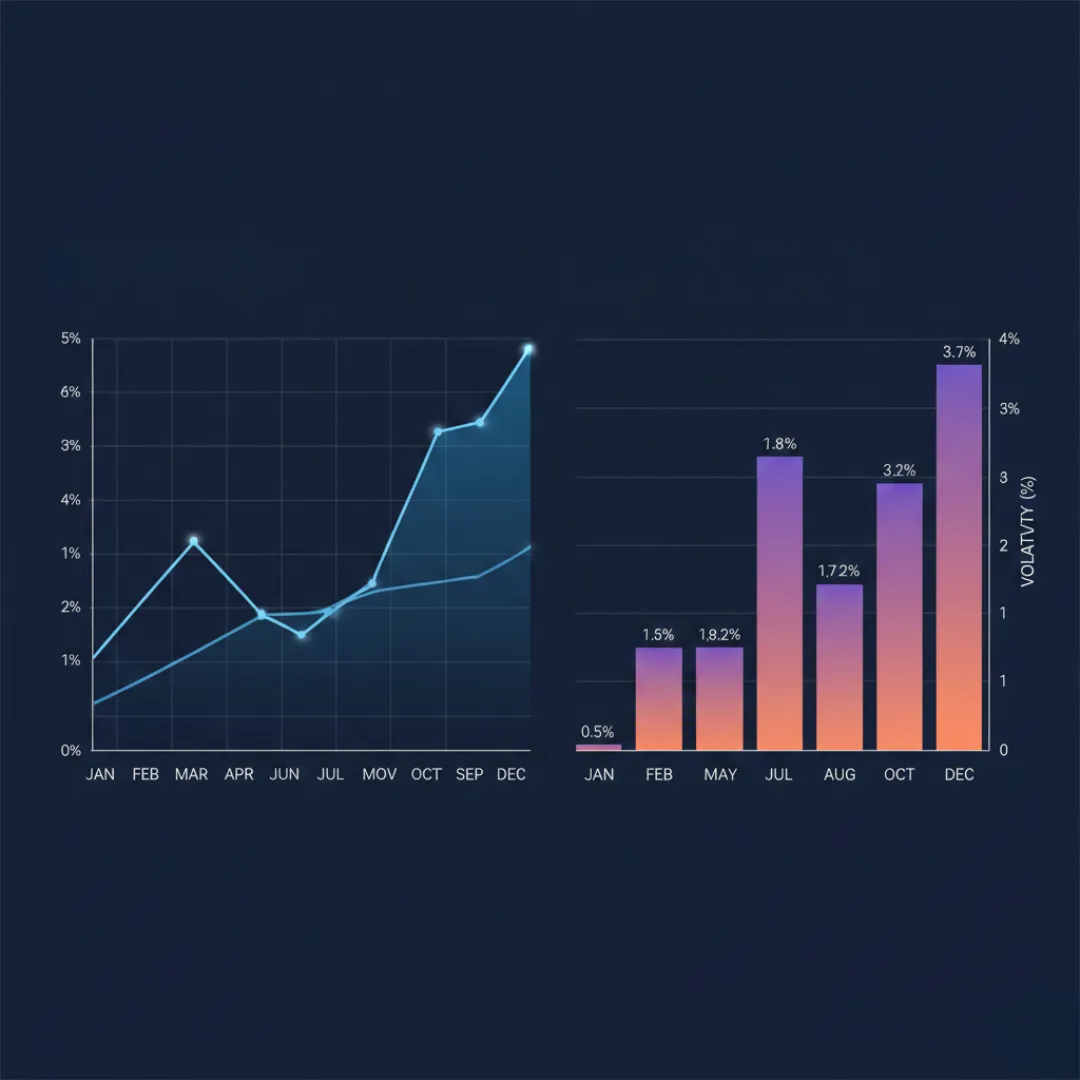

But the last few years have broken that model. Check out the graphs… the first graph is from 2025-2026 and spans 1 full percentage point. The graph directly above is from 2015-2016 and spans only 0.4 percentage points. The graph looks exaggerated… but it’s only because it’s zoomed in over a smaller span.

Here are those same numbers on the same graph:

The volatility amplitude is dramatically higher in 2025. When you plot mortgage rates from 2025 alongside a more ‘normal’ period like 2015, the difference isn’t the level — it’s the instability. A decade ago, rates moved within narrow bands and rewarded patience. Today, rates swing sharply week to week, punishing anyone trying to time the market.

Instead of smooth trends, we’ve had:

rapid spikes

sudden pullbacks

aggressive weekly swings

conflicting forecasts from respected institutions

markets reacting more to data surprises than long-term policy

In other words, the mortgage market has started behaving less like a forecastable curve and more like a living, reactive system.

And that’s why rate direction has lost its power.

Why forecasts keep missing — even from “smart” institutions

It’s tempting to blame bad predictions on bad analysts. But the reality is more complicated.

Organizations like Fannie Mae, the Mortgage Bankers Association, and even the Federal Reserve aren’t guessing randomly. They’re building models based on assumptions that used to hold reasonably well:

inflation cools → rates fall

economic slowdown → rates fall

housing slows → rates fall

The problem is that policy intervention and global capital flows have changed the rules.

We’re in a world where:

government spending remains elevated

liquidity hasn’t fully drained from the system (and won’t because no politicians have the stomach to leave rates elevated to squeeze all the liquidity out)

labor markets stay tight longer than expected

inflation eases, but not cleanly

global investors move money across borders instantly (or pack it into suitcases and fly it right out of Minneapolis/St Paul Airport… but I digress)

bond markets react faster than policymakers can speak

So when a forecast says “rates should be lower by summer,” what it often really means is:

“Under a clean, textbook scenario — without surprises — this is where rates might drift.”

But we are not living in a clean, textbook scenario. Not even close. The models were based on a system when information moved more slowly. Information is now instantaneous.

Volatility is the real enemy of confidence

Here’s where things get practical.

Buyers don’t freeze because rates are high.

They freeze because rates are unpredictable.

A buyer can make peace with a 6.75% mortgage if they believe it’s stable.

They struggle when that same rate could be 6.25% one week… then 7% the next… then back again. And we’ve seen it happen!

Volatility creates three problems at once:

Decision paralysis – “What if I wait one more week?”

Offer hesitation – “What if rates drop right after I commit?”

Budget anxiety – “What if my payment changes before I lock?”

In markets like Massachusetts and Rhode Island — where inventory is already tight — that hesitation matters. It changes who shows up, how aggressive they are, and how confident they feel writing offers.

This is a real thing. Ask any agent working with buyers right now.

Why timing the bottom has become a losing game

In the past, waiting for a rate drop sometimes paid off.

Today, it often doesn’t — because the cost of waiting has risen.

While buyers wait for the “perfect” rate:

prices don’t necessarily fall

inventory doesn’t improve

competition doesn’t disappear

rent keeps rising

life keeps moving

Even small improvements in rates can be wiped out by:

higher purchase prices (you can’t save enough fast enough to make up the difference)

lost negotiating leverage

fewer available homes

bidding pressure returning suddenly (and never left in some price bands)

In other words, people aren’t losing money because they locked at the wrong rate — they’re losing opportunity because they waited for certainty that never arrived.

The mental shift buyers are starting to make (quietly)

More buyers — especially experienced ones — are reframing the question.

Instead of asking:

“Where will rates be in six months?”

They’re asking:

“Can this payment work now, with the option to adjust later?”

That’s a subtle but important shift.

It acknowledges something uncomfortable but honest:

We don’t control rates. We control structure.

Structure includes:

purchase price

down payment

seller concessions

rate buydowns

refinance flexibility

overall financial resilience

Volatility rewards flexibility, not prediction.

What this means for sellers (even if they don’t realize it yet)

Sellers often assume buyers are fixated on rate direction.

In reality, buyers are fixated on monthly payment stability. Society has conditioned us to be that way because it’s easier to sell you something when you don’t think about how much you’re really spending. Instead, you’ve been trained to only think about the monthly payment.

That’s why we’re seeing:

more seller concessions in specific price bands

interest-rate buydowns replacing price cuts (we should see this more often but most agents don’t understand rate buydowns)

stronger response to homes that “feel affordable” on paper

hesitation around properties with HOA or insurance surprises

In a volatile rate environment, certainty sells.

The uncomfortable truth: nobody has a crystal ball — and that’s okay

There’s a strange comfort in forecasts. They make us feel informed, prepared, in control.

But the mortgage market of today doesn’t reward certainty — it rewards adaptability.

Trying to outguess every rate move is exhausting.

Designing a purchase that works across multiple scenarios is empowering.

And that’s the shift happening quietly beneath the noise.

Bottom line

Mortgage rates aren’t just high or low anymore.

They’re unstable.

And in an unstable environment:

prediction matters less

structure matters more

flexibility beats timing

and clarity comes from planning, not guessing

The buyers who succeed in this market aren’t the ones who nail the perfect rate.

They’re the ones who stopped waiting for the market to make them feel comfortable — and built a plan that worked anyway.

References

Federal Reserve Board. (2024–2025). Monetary Policy Reports & Economic Projections. https://www.federalreserve.gov

Mortgage Bankers Association. (2025). Mortgage Finance Forecast. https://www.mba.org

Fannie Mae. (2025). Economic & Housing Outlook. https://www.fanniemae.com/research-and-insights/forecast

Federal Reserve Bank of St. Louis. (2024–2025). FRED: 30-Year Fixed Mortgage Rate; Treasury Yields. https://fred.stlouisfed.org

Wall Street Journal. (2024–2025). Mortgage Rates and Bond Market Volatility. https://www.wsj.com