The Great Rate Reality Check: Why “Sub-6% by Summer” Is Mostly Fantasy

If you’ve been online lately, you’ve probably seen bold claims like:

“Mortgage rates will be under 6% by summer!” or “The Fed is about to pivot — big cuts are coming!”

These sound great. They’re easy to share. And they’re exactly the kind of statements that go viral because people want them to be true.

But here’s the problem:

That is NOT what the data, the history, the Fed, or global markets are actually telling us.

This article is the deep-dive you didn’t know you needed — because rate misinformation is drowning out clear thinking and derailing real-life plans. And, honestly, I didn’t plan on the article being as long as it is… but, I wanted to really understand it and I kept asking questions in my mind… AND I wanted it to be very understandable.

So, it’s all been broken down into logical sections with bullet points and an easy to read paragraph. None of it is rocket science and, when you do take the opportunity to read what I’ve put together here, you’ll be far more informed and understand why I think the rate cuts have been a bad idea and why I believe more liquidity needs to be squeezed out of the market.

We’re going to break down:

what major forecasters really say

why prediction markets disagree

whether a 125 bps drop is even possible (Hint: it’s not unless the economy goes to hell in a handbasket globally)

how government policy broke the normal recession cycle (seriously… crappy government and fiscal policy is the reason everything is so unaffordable… which is the OPPOSITE of a capitalist economy… but I digress)

why that makes high rates stickier

and how Japan’s new interest-rate policy throws gasoline on the fire (new plot twist… and you need to understand this)

Buckle up — this is the first honest look at the path for mortgage rates heading into 2026.

1. Where Rates Actually Are — and What “Sub-6%” Would Require

As of mid-November 2025, the 30-year fixed mortgage rate sits around 6.3–6.4%.

To get to 5.875% or lower, rates would need to fall:

➡️ 100–125 basis points within about 6 months.

That has happened before… but only during economic stress, major recessions, or crisis-level events.

2008 crash

2020 pandemic

2001 dot-com bust

Early 1990s recession

In every case, the big drop came with pain — layoffs, stock declines, credit tightening, or global panic.

So the key question is:

Does today’s economy look anything like the conditions that create a rapid 1.00–1.25% rate drop?

Spoiler: No.

But we need to explore who’s making the bullish forecasts — and why… because there are always ulterior motives (you’ve heard me talk about this before and it’s worth repeating)

2. What Fannie, MBA, and NAR Actually Forecast (Not What Social Media Claims)

Let’s look at the three institutional forecasts people cite most:

🔹 Fannie Mae — Slow, Steady Drift Lower

Q4 2025: ~6.4%

Q4 2026: ~5.9–6.0%

Fannie is NOT predicting sub-6% in mid-2025. Their actual model expects slow, gradual improvement, not a plunge.

🔹 MBA — Rates Stay in the 6.0–6.5% Range

MBA is even more cautious:

Their models keep rates between 6.0% and 6.5% into 2026.

Their commentary: “Improvement will be modest.”

🔹 NAR (Dr. Lawrence Yun) — Slightly Optimistic, but Still Around 6%

Yun is known for optimism, but even he isn’t promising magic:

Rates may average 6% in 2026

No prediction of a sharp, fast decline

The key takeaway:

None of the major forecasters are calling for a quick drop under 6% anytime soon.

The “5-handle by summer” narrative is not supported by their actual publications.

3. Why These Institutional Forecasts Exist — and Why They’re Often Wrong

Economists don’t publish forecasts in a vacuum.

Fannie, MBA, and NAR each have institutional incentives:

Support buyer confidence

Avoid panic

Signal stability

Influence sentiment

Protect market liquidity

This cannot be stated with enough emphasis.

Forecasts are not predictions. They’re scenario planning tools, built on:

Inflation estimates

Labor market assumptions

Fed guidance

Past trends

Historical averages

Recession probability models

They massively struggle with volatility and global shocks.

Which brings us to…

4. Prediction Markets: Why Polymarket & Kalshi Tell a Different Story

I started following the gambling sites to get more real-time data on the markets… because people with gambling problems will gamble on anything. 😄 They’re also harder to influence and show real-time consumer sentiment. It doesn’t mean they’re more accurate and studies have shown their accuracy and reliability are highly variable (for many reasons). But they’re still a good place to get a feel for how the broader market sees potential outcomes. Prediction platforms operate like real-time probability meters for:

CPI

Fed decisions

Interest-rate paths

Mortgage-rate thresholds

Because people stake real money, they react instantly to new data.

Advantages:

Faster than economists

Micro-adjust to new information

Capture “wisdom of the crowd”

Weaknesses:

Overreact to headlines

Can be gamed by whales

Prone to short-term noise

What they currently say:

Low odds of aggressive Fed cuts

Moderate odds of small cuts

Very low odds of rapid mortgage-rate collapse

Betting markets behave like weather forecasts:

They show probabilities, not certainties.

But they’re useful because they challenge rosy narratives. (and you all know how much I love to challenge rosy narratives)

5. The Fed’s Actual Job — And Why It Can’t Cut Fast Right Now

To understand mortgage rates, you must understand the Federal Reserve’s mandate:

1️⃣ Price Stability (Inflation at 2%)

2️⃣ Maximum Employment

Right now:

Inflation ≈ 3% (too high)

Unemployment ≈ 4.3% (not recessionary)

Consumer spending still elevated (of course, so is consumer debt… but that’s a discussion for a different day)

Wage growth still strong

Liquidity remains overabundant

Fiscal policy is expansionary (government still spending aggressively… and they’re willing to hold the American people hostage over it by shutting down the government to protect ridiculous spending because it’s easier to win elections by promising free money than it is promising spending cuts)

Plus:

Political conversations about $2,000 stimulus checks (dumb)

Increased government outlays (big surprise… the fraud is so rampant it’s hard to track)

High deficits (the federal deficit just passed $38T and is on its way to $40T in short order)

All of that keeps inflation from cooling.

The Fed cannot cut rates aggressively until inflation is dead.

And inflation is not dead.

6. Has a 125 bps Drop Happened Without a Crisis?

In modern history?

No.

Major plunges have ONLY occurred during:

2008 housing collapse

2020 global shutdown

2001 twin shocks (dot-com + 9/11)

Early 1990s recession

Large, sudden rate drops require a shock — not a soft landing.

You cannot get:

No recession

Strong labor

Sticky inflation

Government stimulus

Strong consumer spending

High liquidity

AND

Mortgage rates down 125 bps

Those conditions have never existed simultaneously… and they’re not going to anytime soon.

7. How Government Intervention Broke the Normal Recession Cycle

This is the part almost no one in real estate ever talks about:

The U.S. has not had a meaningful recession in 15 years, because government spending keeps preventing them.

Let’s look at the cycle:

Normal economy: recessions happen every 5–7 years

Post-2008 economy: recessions happen only under crisis

2020 recession: 2 months, then drowned in stimulus

Our economy no longer clears out excesses like:

High corporate debt

Asset bubbles

Excess liquidity

Overheating wages

Over-investment in growth sectors

Why?

Because the government uses spending (“G” in GDP) to stabilize downturns.

GDP = C + I + G + (X – M)

When:

Consumers slow

Businesses slow

The government steps in with MASSIVE “G” spending:

Infrastructure

Defense

Disaster relief

Pandemic programs

Climate/energy funding

Direct payments

State/federal subsidies

This artificial “G-boost” prevents recessions — but keeps inflation elevated. Why? Because the government artificially dumps dollars into the economy and we have more dollars chasing the same amount of goods and services. The end result is inflation and, in the current case, very sticky inflation because there’s still too much money floating around the economy.

High inflation = High rates

High government spending = Sticky inflation

Sticky inflation = No rapid rate cuts

This is why mortgage rates stay above 6%. And, historically, these are still great rates. But Qualitative Easing and government intervention kept rates too low for too long (I have a 2.24% mortgage interest rate), devalued the dollar, drove prices up rapidly (because the dollar was cheap and plentiful), and has made things unaffordable for our younger generations.

Anyway, this is all why the Fed’s hands are tied.

8. Why Avoiding Recessions Creates Long-Term Inflation (and High Rates)

Recessions are unpleasant. But they’re economically necessary.

They:

Purge speculative bubbles

Reset wages

Reduce excess spending

Normalize asset values

Tighten credit conditions

Break price spirals

The market corrects itself through recessions.

By preventing recessions:

Prices never correct fully

Wages remain above productivity

The labor market stays too hot

Housing inflation remains structural

Consumer spending stays elevated

Asset values keep rising

Which forces:

Interest rates to stay higher for longer.

In other words:

We’re paying for 15 years of “painless economics.”

And if you disagree, prove me wrong. Please.

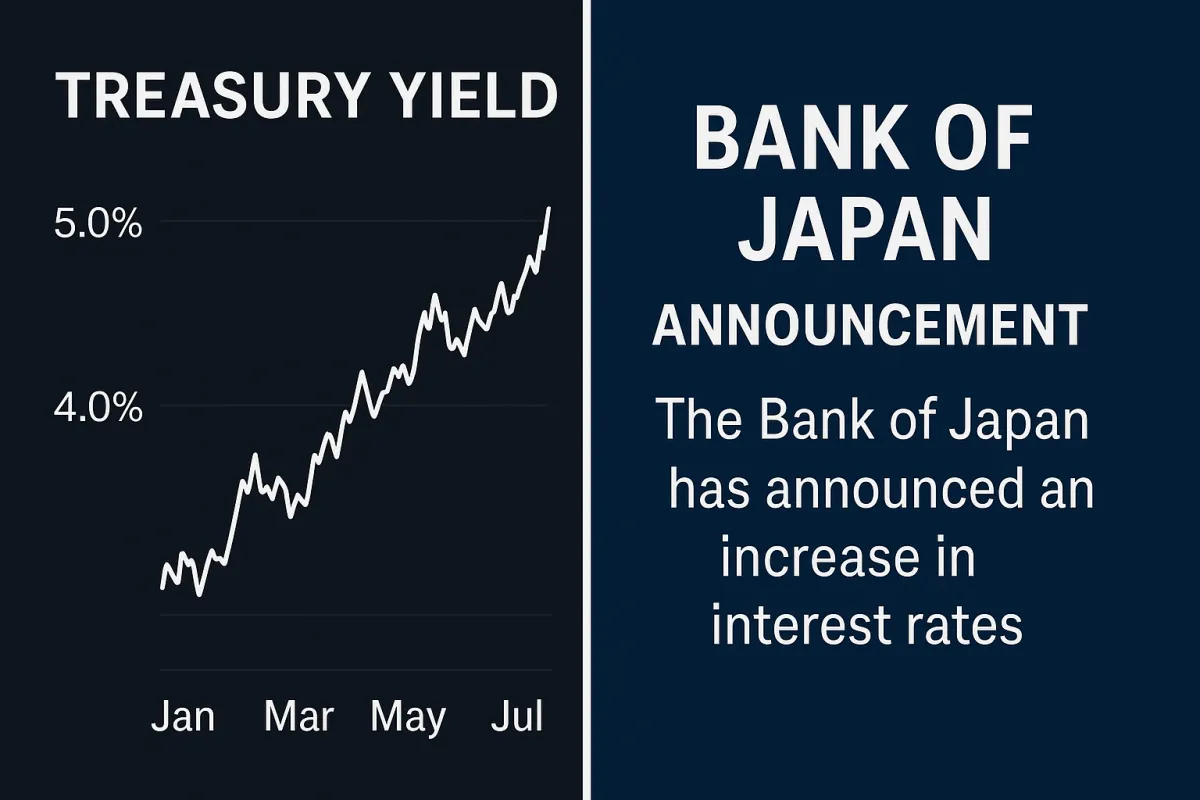

9. The Japan Problem: Why BOJ’s Rate Hike Pushes U.S. Mortgage Rates Higher

This is the biggest under-reported factor of all.

Japan raised interest rates off negative levels for the first time in decades. And I’m sure you’re thinking, “Ryan, why does that matter here? I mean… who cares what happens to the cost of Japanese Government Bonds (JGBs)?”

Because Japan is one of the largest foreign buyers of U.S. Treasuries! That’s why!

When Japan raises rates:

Japanese investors sell U.S. Treasuries

They buy Japanese Government Bonds (JGBs) instead

Treasury prices drop

Treasury yields rise

Mortgage rates rise with them

U.S. mortgage rates follow the 10-year Treasury yield.

Less foreign demand → higher Treasury yields → higher mortgage rates.

And it gets worse:

A stronger Yen → weaker U.S. dollar → more expensive imports → stickier U.S. inflation → slower Fed cuts.

BOJ’s policy change is a global headwind to lower U.S. mortgage rates.

10. So What Should Buyers, Sellers, and Investors Believe?

This is the simple, truthful framework:

Most Likely Scenario (2025–2026)

Rates drift down slowly

Improvement of 25–50 bps in 12 months

Possibly high 5s by late 2026

No rapid collapses without crisis

Optimistic Scenario

Inflation cools

Fed cuts modestly

Rates settle near 5.75%–6.0% in late 2025 or early 2026

Unrealistic Scenario

Rates drop 125 bps in 6 months

No recession

No shock

No inflation spike

The Recession Scenario

Something breaks

Rates fall sharply

Demand dries up

Not a “win” for anyone

11. The Bottom Line (The One Sentence Every Client Should Hear)

Plan your life around reality — not around someone’s favorite mortgage-rate fantasy. Rates will likely stay in the 6s longer than people want, and that’s OK. You don’t need a 5-handle to make a smart move.

References

Fannie Mae. (2025). Economic and Housing Outlook.https://www.fanniemae.com

Mortgage Bankers Association. (2025). MBA Mortgage Finance Forecast.https://www.mba.org

National Association of Realtors. (2025). Economic Outlook 2025–2026.https://www.nar.realtor

Federal Reserve. (2025). Monetary Policy Report.https://www.federalreserve.gov

CME Group. (2025). FedWatch Tool.https://www.cmegroup.com

Polymarket. (2025). Mortgage & Fed Markets.https://polymarket.com

Kalshi. (2025). Interest Rate Event Contracts.https://kalshi.com

Freddie Mac. (2025). Primary Mortgage Market Survey.https://www.freddiemac.com/pmms

U.S. Treasury. (2025). Major Foreign Holders of Treasury Securities.https://home.treasury.gov

Bank of Japan. (2025). Monetary Policy Statement.https://www.boj.or.jp