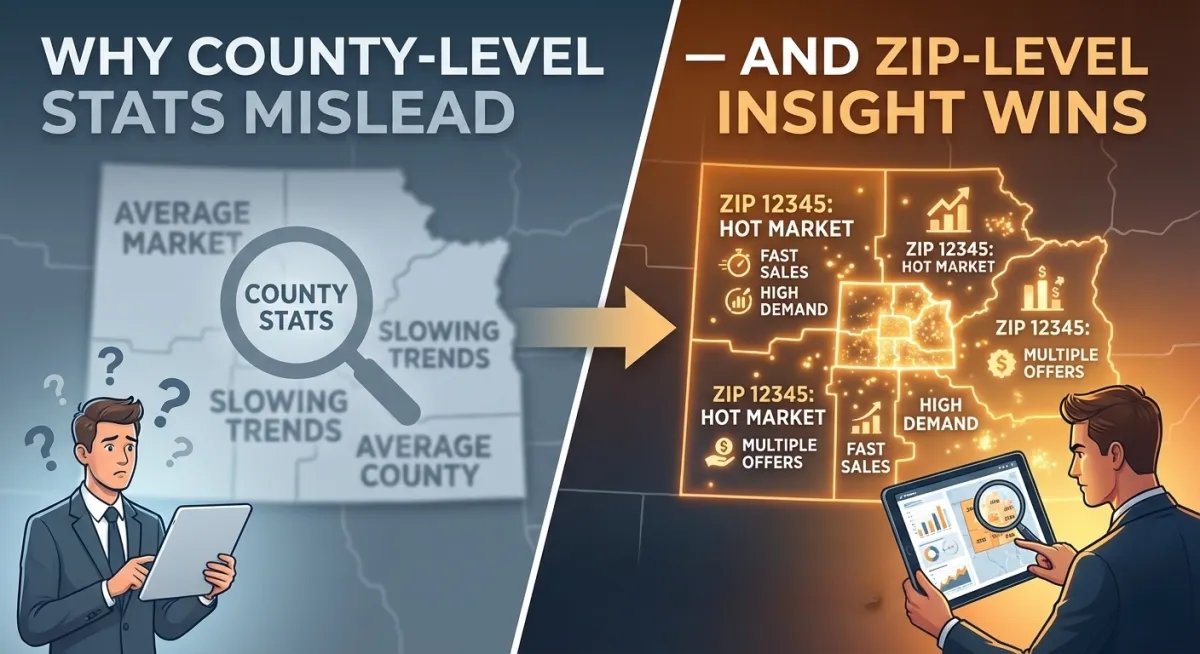

Why County-Level Stats Mislead — and ZIP-Level Insight Wins

Why County-Level Stats Mislead — and ZIP-Level Insight Wins

If you only pay attention to headlines, you’d think buyer demand has vanished.

Rates are higher. Affordability is tighter. Inventory is up over 14% in MA… and down nearly 39% in RI (this, alone, proves my point)!

The conclusion seems obvious: the market is slowing.

And yet… some homes still sell in days. Multiple offers still happen. Certain listings spark urgency while others sit untouched for months — sometimes in the same county, sometimes in neighboring towns.

That’s not a contradiction.

It’s a compression effect — and county-level statistics completely miss it.

Why County Data Fails at Decision-Making

The problem with county data isn’t that it’s wrong.

It’s that it’s too averaged to be useful.

Real estate decisions don’t happen at the county level. Buyers don’t experience “the county market.” Sellers don’t price their homes against county medians. They experience very specific ZIP codes, very specific price bands, and very specific buyer psychology.

When we rely on county-level stats, we flatten all of that behavior into a single narrative. Fast-moving ZIPs get blended with slow ones. Aggressive price bands get averaged with hesitant ones. Urgency disappears inside the mean.

That’s why agents say, “The market is slowing,” and clients respond, “Then why did that house sell in a week?”

Heck, Easton and Mansfield are adjacent towns in Bristol County. Yet Mansfield has only 6 active homes on the market while Easton has 24. Homes in Mansfield sell in 27 days on average while it’s 47 days in Easton. And Easton’s homes sell for 11.5% more, on average, driven by multiple home sales at prices beyond Mansfield’s market.

What ZIP-Level Data Reveals Instead

ZIP-level data answers that question.

When you examine activity by ZIP instead of county, a different story emerges. Days on market don’t move evenly. Price reductions don’t occur randomly. Buyer urgency doesn’t evaporate — it concentrates.

As affordability tightens, buyers don’t disappear. They narrow their range. They compete harder inside fewer options. Demand compresses into specific price bands and locations where payments still make sense, trade-offs feel acceptable, and risk feels “worth it.”

That’s why the market can feel slow and competitive at the same time — depending entirely on where you’re standing.

The Compression Effect in Plain Language

Inside the same county, it’s common to see one ZIP averaging under 20 days on market while another pushes past 60. One price band absorbs listings quickly while another accumulates reductions.

County averages smooth over those differences.

Buyers and sellers live inside them.

This is where agents either gain authority — or lose it.

Agents who rely on county stats end up speaking in generalities. They reassure instead of orient. They explain outcomes after they happen instead of framing expectations before decisions are made.

How ZIP-Level Insight Changes Buyer Conversations

Agents who understand compression speak differently.

They don’t say, “The market is tough.”

They say, “Competition hasn’t disappeared — it’s concentrated. The question isn’t whether buyers are competing, it’s where.”

They don’t respond to hesitation with, “We can always wait.”

They explain, “Waiting doesn’t reduce competition in the price ranges buyers still want. In many cases, it actually increases it.”

This reframes risk away from emotion and toward structure — which is exactly what uncertain buyers need.

How ZIP-Level Insight Reframes Seller Strategy

On the listing side, ZIP-level insight is just as powerful.

Instead of telling sellers the market has slowed, agents can explain:

why pricing precision matters more in certain bands

why reductions cluster where they do

why “buying time” often costs leverage instead of creating it

Sellers don’t need optimism.

They need orientation.

Why This Matters More Than Market Headlines

Most market commentary tells you what happened. This is an important distinction. When you read about it in the news, it happened at least 30 days ago, typically.

ZIP-level insight explains why — and what’s likely to happen next.

Agents who can explain compression don’t sound reactive.

They sound prepared.

They stop reporting the market and start interpreting it.

And interpretation is what creates trust.

The Real Takeaway for Agents

The market isn’t slow.

It’s selective.

This is a key concept that you must internalize.

There are always price bands in specific ZIP codes where homes move — in every market cycle. Agents who learn to identify where demand is compressed, explain why competition still exists, and translate that insight into decision-making language stop competing on personality and start competing on clarity.

That’s the bridge between research and authority.

And it’s exactly where agents separate themselves from the noise.

And the TikTok videos.